When it comes to managing debt, understanding the impact of interest rates is crucial. These rates play a defining role in shaping your debt repayment plan, influencing not just the cost of borrowing but also how long it takes to pay off loans. In this article, we will explore how interest rates affect your financial commitments and provide actionable strategies to optimize your repayment plan.

Understanding How Interest Rates Shape Your Debt Repayment Strategy

Definition of Interest Rates in the Context of Loans and Debt

Interest rates are the cost of borrowing money, expressed as a percentage of the loan amount. They represent the lender’s compensation for providing you with funds. Whether you’re dealing with credit cards, personal loans, or mortgages, interest rates significantly influence your repayment plan.

The Role of Interest in Determining Loan Costs

Interest payments can make up a substantial portion of your monthly installments, especially early in the loan term. The higher the interest rate, the more you pay over time.

Different Types of Interest Rates and Their Implications

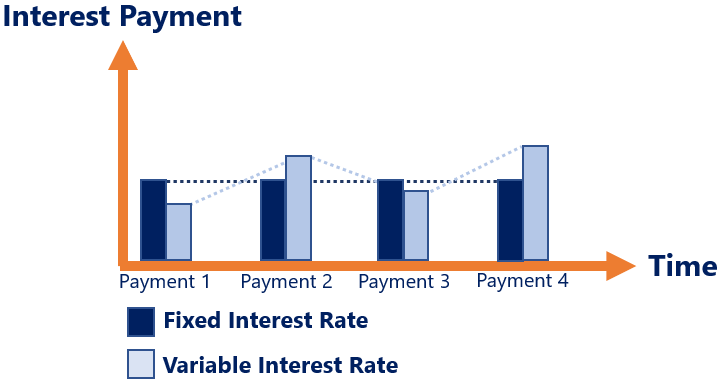

- Fixed Interest Rates: These rates remain constant throughout the loan term, providing predictability in monthly payments.

- Variable Interest Rates: These rates fluctuate based on market conditions, which can lead to unpredictable changes in your repayment amounts.

How a Change in Interest Rates Affects Loans

An increase in interest rates leads to higher monthly payments and a greater total cost over the life of the loan. Conversely, a decrease can shorten the repayment timeline and reduce overall expenses.

Interest Rates and Their Influence on Debt Instruments

Understanding Debt Funds and Interest Rates

Debt funds, such as bonds and treasury securities, are directly impacted by interest rates. When rates rise, bond prices typically fall, affecting returns for investors.

How Interest Rates Impact Debt Investments

Higher rates can make borrowing more expensive for individuals and corporations, potentially leading to increased risks for lenders and investors.

Borrowers and Debt Management

For borrowers, rising interest rates can strain budgets, while falling rates may offer opportunities to refinance existing loans at lower costs.

Market Responses to Changing Interest Rates

Consider how central bank decisions, such as the Federal Reserve’s interest rate adjustments, ripple through financial markets. For example, a rate hike might cause mortgage rates to increase, affecting homeowners’ repayment plans.

Learn more about Federal Reserve rate changes

Calculating the Financial Impact of Interest Rate Variations on Monthly Payments

How a 1% Change in Interest Rates Affects Payments

A small change in interest rates can significantly impact monthly payments. For instance, on a $200,000 mortgage with a 30-year term, a 1% rate increase might raise monthly payments by several hundred dollars.

Effects on the Overall Loan Amount

Higher interest rates increase the total amount repaid over the loan’s life. Using the previous example, a 1% rate hike could mean tens of thousands more in total interest costs.

Scenarios Illustrating Rate Impacts

- Scenario 1: A borrower with a fixed-rate mortgage benefits from stable payments despite rising rates.

- Scenario 2: A variable-rate loan borrower faces escalating costs when rates increase.

Practical Strategies for Managing Debt

- Refinance During Low-Rate Periods: Lock in lower rates to reduce long-term costs.

- Prioritize High-Interest Debt: Focus on paying off loans with the highest rates first.

- Maintain an Emergency Fund: Avoid high-interest borrowing during financial emergencies.

Key Takeaways for Debt Management and Interest Rates

Interest rates profoundly affect debt repayment plans. By understanding how interest rates affect debt and planning strategically, you can reduce financial stress and accelerate your path to financial freedom. Stay informed, monitor rate trends, and adjust your repayment plan to align with current market conditions.

Try this loan repayment calculator to explore how interest rate changes impact your finances.